On Sept. 1, student loan interest and payments resumed after a pause during the COVID-19 pandemic.

For graduates and even some current students of Newman who took out loans, this means interest rates have resumed and the first loan payment is due in October.

Director of Financial Aid Myra Pfannenstiel advises that graduates and students be proactive and take the first steps toward establishing a repayment plan.

“Go to studentaid.gov, confirm what your debt is, who your servicer is and what you’re interest rate will be using your FSA ID and password,” Pfannenstiel said. “If you don’t have it, you can reset it. That way students can be informed and have the data they need to make the correct decision on which repayment plan to sign up for and prepare.”

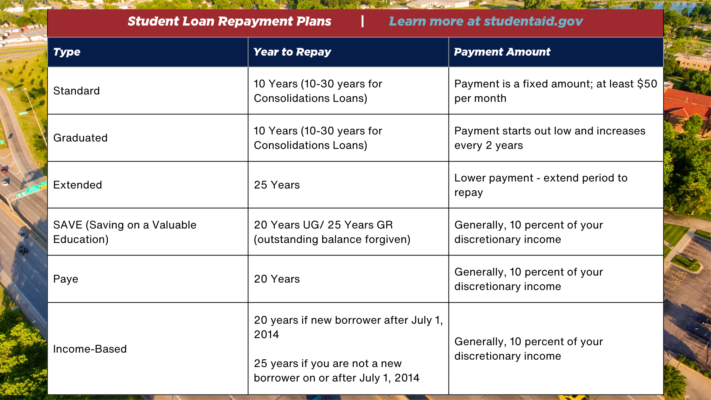

There are several repayment plans to choose from, each with different amounts and time frames. Automatic payment options each month are also available through the studentaid.gov website.

“There’s also a loan simulator on studentaid.gov that allows users to gather their data, plug it in and see which is best for them and their budget,” she said.

Additionally, the Department of Education has established an on-ramp transition period. Payments and interest will continue, but this period protects borrowers from having a delinquency reported to credit reporting agencies and prevents the worst consequences of missed, late or partial payments. The on-ramp period will continue through Sept. 30, 2024.

Pfannenstiel said Newman plans to continue communicating with students as they graduate — or if they choose to transfer or drop out and do not return — to ensure they have the resources they need to begin the loan repayment process.

In a recent interview with KSN News, Associate Professor Larry Straub said, “There is like $1.8 trillion in student loan debt right now, so this is a very widespread issue.”

While it is difficult, he says there are many resources that can help.

Pfannenstiel and Straub both encourage borrowers to start by building a personal budget.

“Get creative and if it looks like there’s trouble, there are lots of financial resources out there to help, including credit counseling,” Pfannenstiel said. “Don’t be afraid to reach out if you need help finding those resources.”

Need help finding the resources you need? Email [email protected].

Review your student loan repayment plan

Login to studentaid.gov using your FSA ID to get started on student loan repayment plans.